(Gold Price): An Investment Perspective (invaluable asset-class)

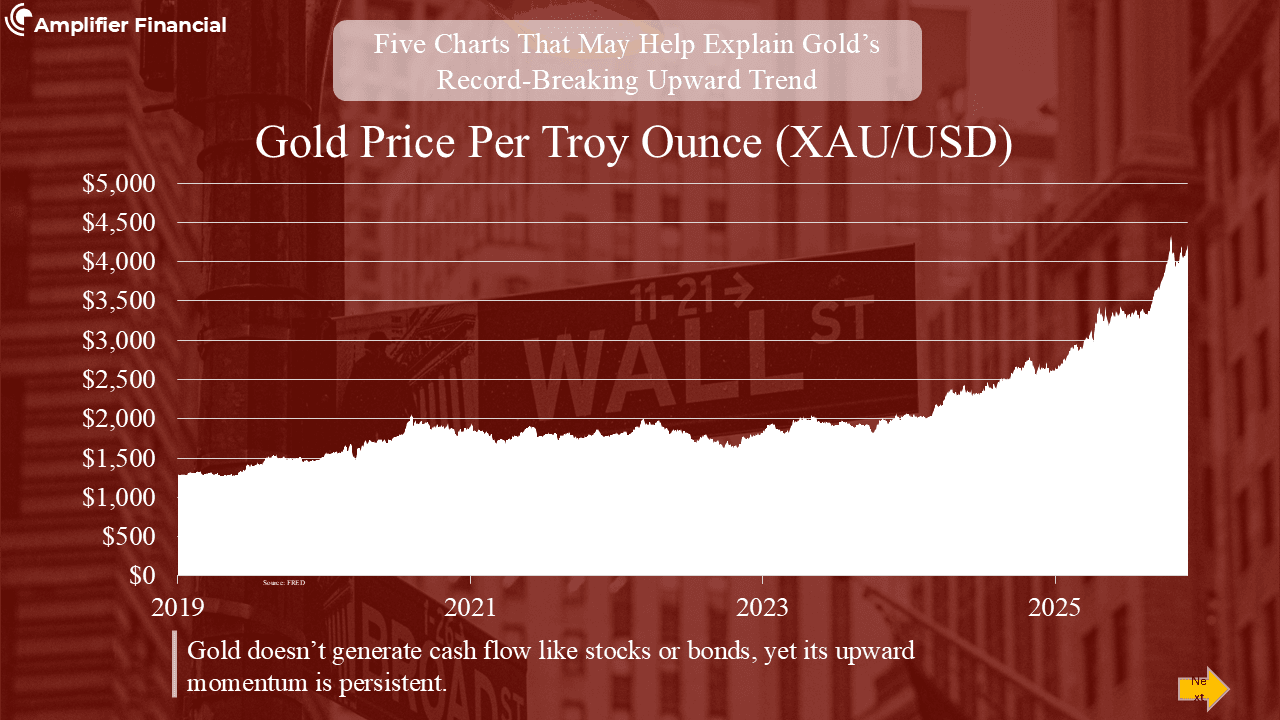

Gold Price

Gold has been a symbol of wealth and power for thousands of years. From ancient civilizations to modern economies, this precious metal has maintained its allure and value. Recently, gold price has been upward trending, making it one of the best performance asset classes. Gold price increases when the uncertainty is high as gold serves as a stable currency and store of value.

What's driving gold price higher? We will display 5 charts that may help explain it.

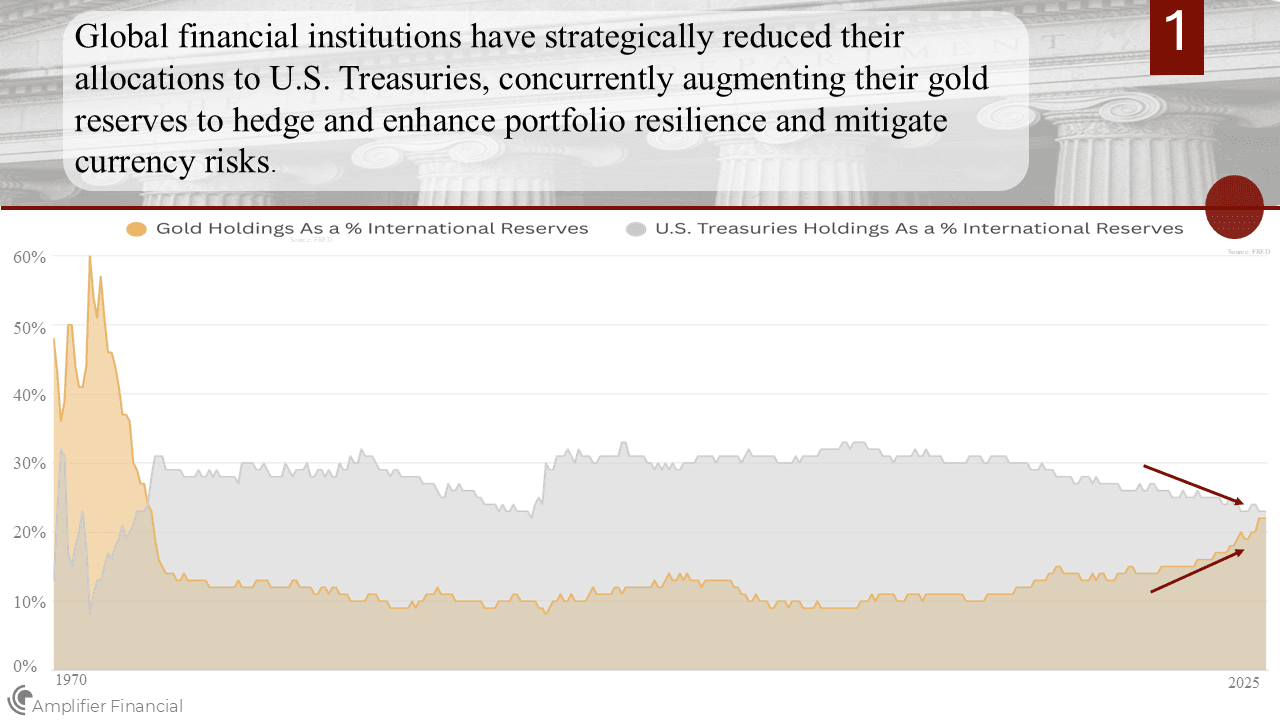

The above chart illustrates how financial institutions have increased their gold holdings over the past few years.

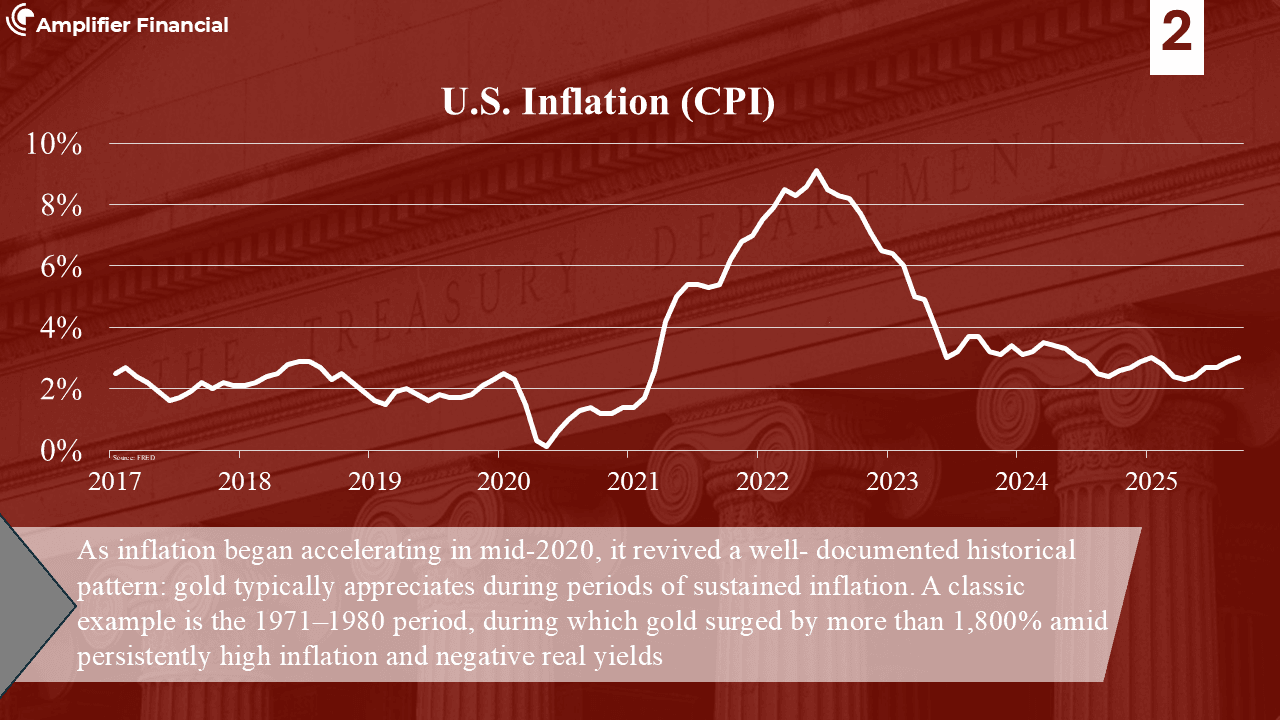

This chart shows how inflation has remained persistent, leading institutions to favor holding more gold during such periods.

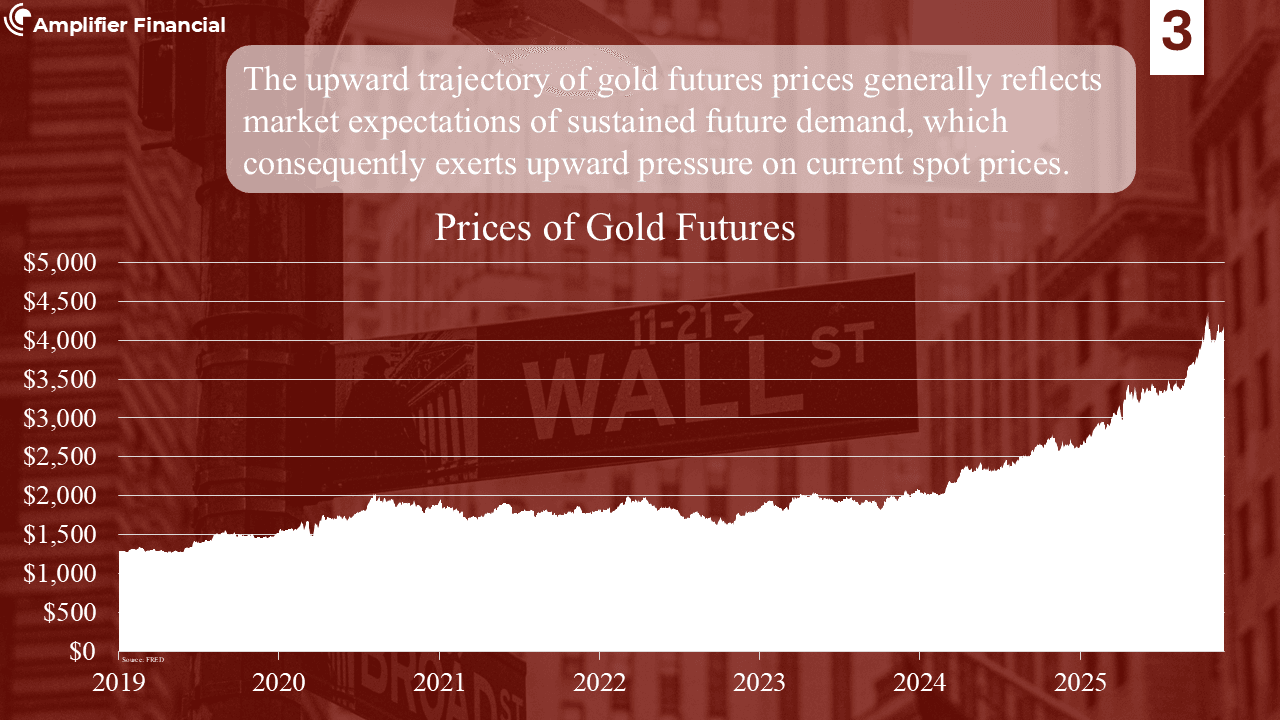

The chart above depicts the consistent growth in gold futures prices, indicating that demand for gold is likely to continue.

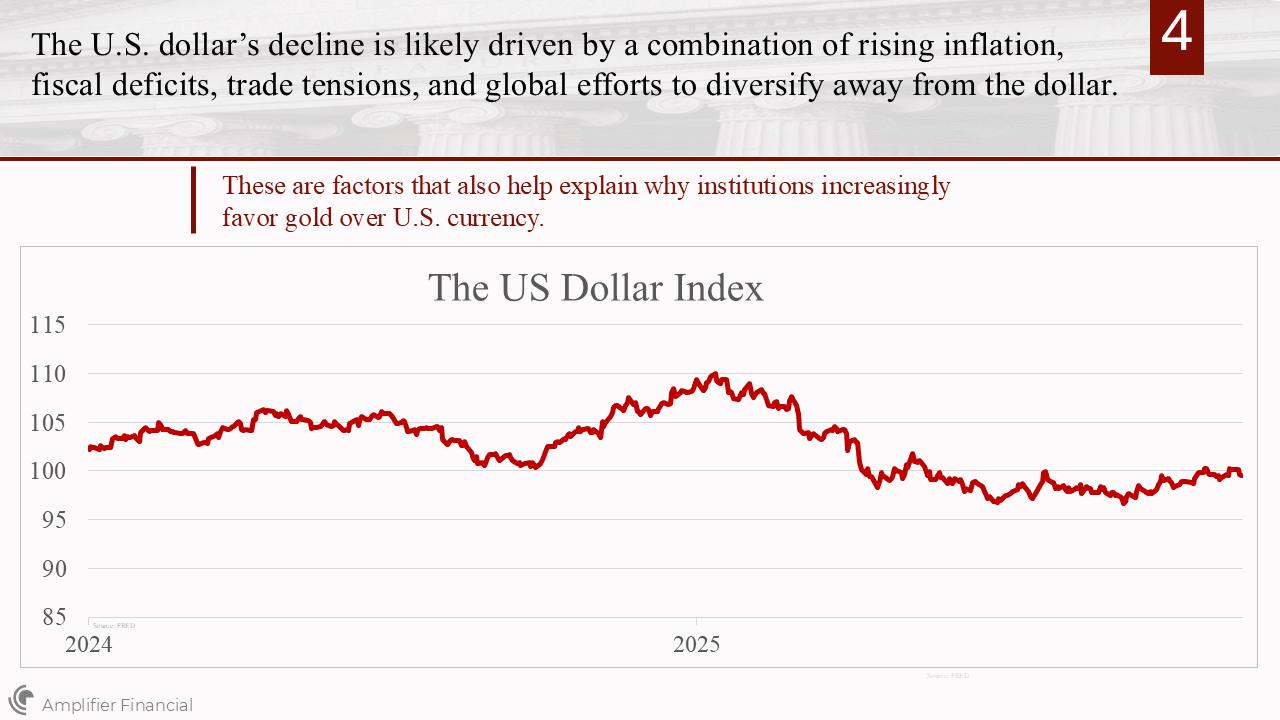

The U.S. Dollar Index shows a downward trend in global appetite for the dollar, indicating that investors are reducing their demand for U.S. currency. As a result, many are increasing their gold exposure to rebalance and strengthen their portfolios.

The debt-to-GDP chart clearly illustrates why many investors are increasingly worried about U.S. debt. Rising debt-service costs have been placing a growing burden on the U.S. budget, which further exacerbates concerns among U.S. Treasury holders.

Putting it all together, several factors have fueled the rising demand for gold, pushing prices higher. The key question now is what investors need to see in order to feel more optimistic about the U.S. and global markets, and ultimately reallocate some of their gold holdings back into cash-flow-generating assets such as corporate bonds, equities, or U.S. Treasuries?